south dakota property taxes by county

Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

South Dakota Sales Tax Small Business Guide Truic

Ad Find Out the Market Value of Any Property and Past Sale Prices.

. But South Dakota also allows additional levies for roads snow removal and buildings as well as other taxing entities. The typical homeowner here pays 2535 in property taxes each year. The Department of Revenue has all the answers here.

Ad See Anyones Official South Dakota County Records. If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County.

To 5 pm Monday - Friday. Special assessments are due by April 30 th also. Of course these counties have the highest number of residents but how are property taxes calculated in South Dakota.

First half property taxes are due by April 30 th. Please call the Treasurers Office at 605 367-4211. Median Property Taxes No Mortgage 988.

For example between 2000 and 2019 property taxes in South Dakota increased 114 he said. If you own property in Lincoln County then you pay the highest amount at 2470. Payments can be mailed to Pennington County Treasurer PO Box 6160 Rapid City SD 57709.

South Dakota is ranked number twenty seven out of the fifty states in order of the average amount of property taxes. See Available Property Records Liens Owners Mortgage Info. First half property taxes are due by April 30 th.

Real Estate taxes are paid one year in arrears. Second half are due by October 31 st. In addition all taxes under 50 are due and payable in.

Enter A Name To See Results Instantly. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Whatever You Need Whatever You Want Whatever You Desire We Provide.

South Dakotas property taxes are higher than necessary Trabert said. To protect your privacy this site uses a security certificate for secure and confidential communications. To qualify the following conditions must be met.

SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed including taxes interest penalties and additional costs incurred. The collection of all real estate and mobile home taxes all vehicle registration titling and licensing implementing procedures for delinquent real estate and mobile home tax. Median Property Taxes Mortgage 1181.

SDCL 10-24-1 Person can redeem property sold at sale at any time before tax deed is issued amount to. The head of the household must be sixty-five years of age or older or shall be disabled prior to January first of the year in. Search Any Address 2.

Custer County collected more than 10 million in real estates taxes in 2008. Ad Search for south dakota property tax. Taxes that accrue in 2008 are due payable in 2009 Tax notices are mailed by mid-February.

In South Dakota the County Treasurer has the responsibility of receiving and managing all funds due the county. Lincoln County has entered an agreement with GovTech Service Inc for online property tax payments. Of that 14 billion or 203 of the total revenue collected comes from property taxes.

Some of the duties the Treasurer is responsible for are. Minnehaha County-2062 and Pennington County-1995. Taxes that accrue in 2019 are due and payable in 2020 Tax notices are mailed by mid-February.

This site is designed to provide you with additional methods to research your property information and to allow you to pay your property taxes online. By the assessed market value of your property. The money from the taxation of these vehicles is collected and remitted to the state of South Dakota.

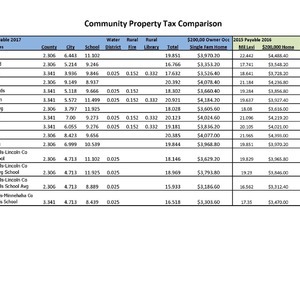

Then the property is equalized to 85 for property tax purposes. For an additional convenience fee listed below you may pay by ACH or credit card. In South Dakota the maximum county tax levy is 12 mills or 12 per thousand dollars of assessed value.

The countys average effective property tax rate is 141. 33 rows South Dakota Property Taxes by County. The county treasurer also collects property taxes for the county city school districts and any other political district authorized to levy real estate taxes.

Haakon County Property Tax Payments Annual Haakon County South Dakota. To view all county data on one page see South Dakota property tax by county. Second half are due by October 31 st.

A home with a full and true value of 230000 has a taxable value 230000 multiplied by 85 of 195500. That is twice the rate of. Ownerly Helps You Find Data On Homeowner Property Taxes Deeds Estimated Value More.

Real Estate taxes are paid one year in arrears. Convenience fees 235 and will appear on your credit card statement as a separate charge. Tax amount varies by county.

Redemption from Tax Sales. Please notate ID wishing to pay. It contains Rapid City the second-largest city in South Dakota.

SDCL 10-18A-1 to 10-18A-7 states that certain low income property owners are eligible for a property tax refund and should check with their county treasurer for details and assistance in making application. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85. In South Dakota the county treasurer is responsible for issuing motor vehicle.

If your taxes are delinquent you will not be able to pay online. This eastern South Dakota county has the highest property taxes in the state. So at that rate our 10000 piece of property would cost us 120 in taxes.

For more details about the property tax rates in any of South Dakotas counties choose the county from the interactive map or the list below.

Property Tax South Dakota Department Of Revenue

Tax Information In Tea South Dakota City Of Tea

Property Tax South Dakota Department Of Revenue

Chart 4 South Dakota Local Tax Burden By County Fy 2015 Jpg South Dakota Dakota Burden

South Dakota Property Tax Calculator Smartasset

Tax Information In Tea South Dakota City Of Tea